Ethereum Smashes Through $3,000 as Crypto Rally Grows, SOL, IMX, VET, Feb. 26

ETH

Ethereum blew through the $3,000 level to trade at $3,134 after a gain of over 6% this week.

The world’s second-largest cryptocurrency topped the $3k level for the first time since Apil 2022, reaching a market cap of $377 billion.

Ethereum was boosted by whale activity with large investors soaking up $500 million of supply in only 24 hours. Santiment’s Supply Held by Top Addresses data shows the number of coins held in the largest wallet. The latest data showed the top 1,000 ETH wallets held a cumulative opening balance of 69.51 million ETH on Friday. But those large users added 170,000 ETH over the weekend, bringing their cumulative balance to 69.68 million ETH.

Analysts are closely watching the coming Ethereum Dencun upgrade scheduled for March, which is set to revolutionize the functionality of the ETH chain and strengthen its position in the market. A recent research report from Grayscale highlighted the project’s plans to become a more secure and scalable settlement layer for decentralized applications (dApps). The coming aims to reduce data costs and improve margins for Ethereum-based Layer 2 scaling solutions.

Grayscale said the upgrade is a strategic move to enhance Ethereum’s scalability while preserving its security, amidst growing Layer-2 competition. Grayscale also noted that Ethereum 2.0, with its shift to a modular network, has led to the development of scaling solutions like Optimism (OP) and Arbitron (ARB), and data solutions like Celestia (TIA).

These scaling projects have shown significant growth in Total Value Locked (TVL) and user engagement on Ethereum, which also adds to the network’s scalability. Grayscale said that the growth of these third-party projects could lead to increased competition and innovation within the ecosystem, strengthening Ethereum’s functionality.

The latest move higher in ETH puts the $3,500 area resistance in sight as the next target.

BNB

Binance Coin (BNB) was the largest gainer in the top ten cryptocurrencies this week with a return of 12%.

The project has continued to benefit from increased trading flows into cryptocurrencies and has shrugged off its previous legal woes.

The project’s founder and CEO, Changpeng Zhao, was forced to step down back in November over ongoing investigations into lax regulations at the firm and 100,000 suspicious transactions involving unsavory groups and investors.

A U.S. judge on Friday accepted a guilty plea from the crypto exchange and a more than $4.3bn penalty for violating federal anti-money laundering and sanctions laws. Judge Richard Jones in Seattle approved the plea, which also includes a $1.8bn criminal fine and $2.5 billion of forfeiture, about an hour after the government proposed changes to Binance founder Zhao’s bond.

In a statement on Friday, Binance said it accepted responsibility, but has upgraded its anti-money laundering and “know-your-customer” protocols, and has made “significant progress” on changes required by regulators.

These developments have helped to remove a lot of doubt over the exchange and kept deposits on the exchange while trading has grown with the bull market. Binance currently has a 24-hour trading volume near $20 billion which is almost ten times larger than its nearest rival Coinbase at $2.88. Binance has 14,000,000 weekly visits compared to 68,000 at its rival.

Binance Coin has doubled in price from its October woes and has tested the $400 level which goes back to 2022, ahead of the FTX collapse. The market will continue to look for resistance but continued inflows will keep the price bid.

UNI

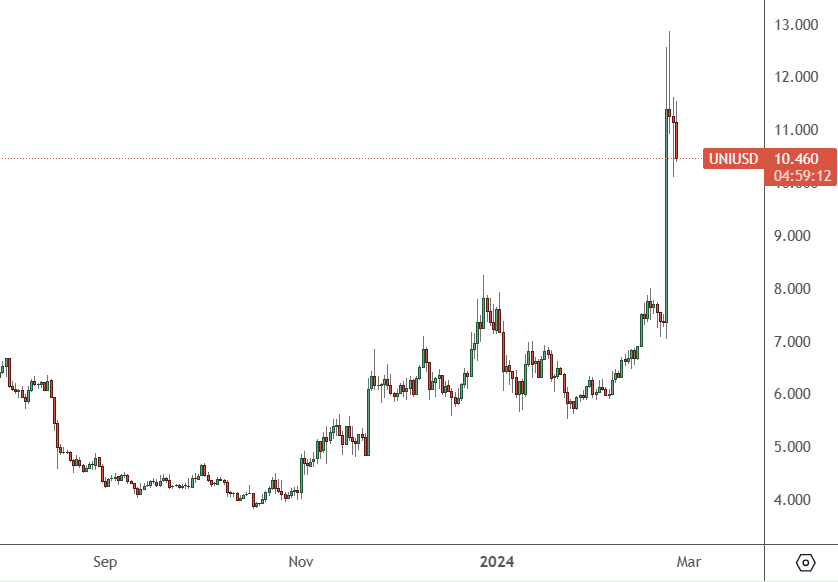

Decentralized exchange Uniswap is another project benefiting from the crypto boom with a 37% gain in the price of the native token over the last week.

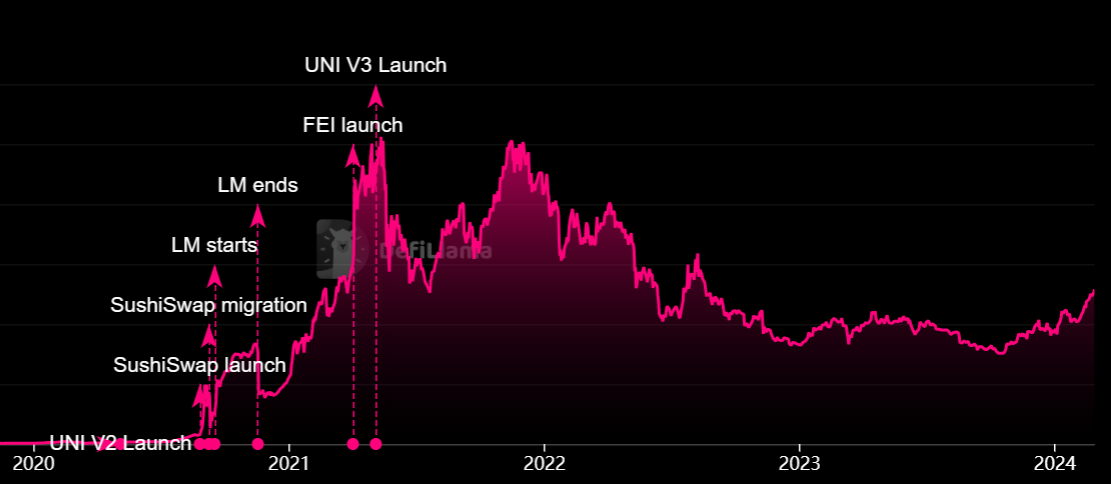

The DEX now has a Total Value Locked (TVL) of around $5.14 billion and that has been growing steadily since the lows of $3 billion in 2023 as the chart from DefiLlama highlights.

Version 3 of the popular decentralized exchange was launched in 2021 but that coincided with the bear market and the fallout of the FTX exchange collapse, which should’ve seen a rush to non-centralized exchanges but has seen them stabilize as with the case of Binance.

Uniswap has seen its token surge recently over a proposal to reward token holders in a major upgrade to the governance protocol. The upgrade would reward UNI token holders who staked and delegated their tokens, according to the proposal.

The proposal plans to “strengthen and invigorate” Uniswap’s governance, with Erin Koen of Uniswap saying on X:

“I believe we should upgrade the protocol so that its fee mechanism rewards UNI token holders that have staked and delegated their tokens.”

Koen suggested it was the “biggest week ever” in the project’s governance.

A proposal last June was rejected by the Uniswap community that would have turned on fees for some of the exchange’s liquidity pools and distributed part of the revenue to its token holders

Data last week showed that Uniswap also surpassed Bitcoin in trader fees for the week. As of February 25, Uniswap’s fees hit $1.9M, outdoing Bitcoin’s $1.2M, according to Cryptofees.

UNI now trades above $10.00 with a market cap of almost $6.3 billion.