Happy Birthday, Bitcoin! The Coin That Fulfilled a Dream

Fourteen years ago, on Jan. 3, 2009, an individual or group of developers named Satoshi Nakamoto introduced the Bitcoin network to the world and block zero on a Saturday afternoon. Satoshi’s technology removes the need for any financial institution’s involvement when a payment is sent from one party to another. Since its inception, Bitcoin has profoundly altered the financial system, spawning a whole cryptocurrency economy worth more than $800 billion.

Bitcoin, the first cryptocurrency project to be successfully completed, inspired the creation of other digital coins, like Litecoin, Namecoin, Peercoin, Dogecoin, and so on. However, only Ethereum succeeded in being the second-largest cryptocurrency in the world by market value, which is why it makes a sound long-term investment for many.

If you’re an aspiring successful crypto trader, register and familiarize yourself with a widely-used crypto platform and check the Bitcoin price. When you’re comfortable with the price, determine how much you want to invest and don’t overspend or make biased decisions. The same goes for Ethereum or any other cryptocurrency, as they’re highly volatile, and nothing can guarantee returns.

Last but not least, keep reading to discover more exciting things about this revolutionary technology, Bitcoin.

A story of hope

Following the massive collapse of the US banking behemoth, Lehman Brothers, public distrust in financial institutions and central governments reached an all-time high, as it sent economic shocks across the globe. Several smaller banks declared bankruptcy before the Wall Street collapse, and others followed soon after.

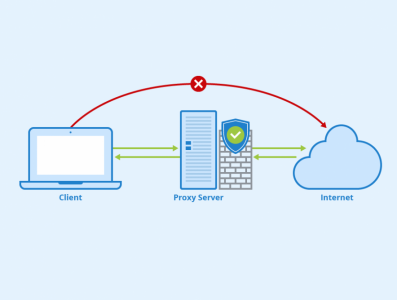

At a time when losses were common in the financial sector, Satoshi came out of the ashes with a white paper portraying a bright and cheerful image of the future. Bitcoin was created to address long-standing inefficiencies in the financial system by enabling transparency and anonymity in peer-to-peer transactions. It effectively removes the need for a middleman like banks, which were once considered “necessary” and “trustworthy” before the fallout.

Remember how people in the Philippines played Axie Infinity for NFTs and crypto as rewards when the pandemic hit and left them with fewer sources of income? BTC’s ability to lift communities out of poverty is undeniably encouraging.

An unforgettable moment

Unsurprisingly, a revolutionary asset like Bitcoin would, at some point, face opposition and challenges. And it did so on multiple occasions, particularly in its early years. Bitcoin’s price saw highs and lows, and this is how the concept of a “bear market” began to spread.

The first Bitcoin transaction took place when a Finnish computer science student named Martti Malmi sold, in October 2009, 5,050 BTC, giving each coin a valuation of $0.0009.

However, one of the most memorable transactions in history is that of now-famous programmer Laszlo Hanyecz. In 2010, he purchased two pizzas from Papa John’s for 10,000 Bitcoin. At today’s value, that would be about $167.3 million. The purchase has become a crypto community event, with May 22 being designated as “Bitcoin Pizza Day.”

Fast forward, Bitcoin reached a $1 valuation in February 2011. The asset’s value climbed to $10 shortly after and then to $30, resulting in a 30-time leap for that year. In 2013, it crossed $1.000 per token. The all-time high occurred in November 2021, when BTC’s valuation exceeded $65,000.

When Satoshi, the famed Bitcoin (BTC) creator, mined its first block on Jan. 3, 2009, he was awarded 50 BTC. By today’s standards, the sum would be enormous for the token’s worth. However, because Satoshi didn’t send the transaction to the global transaction database, his incentive can’t be spent. The reason why it happened is unclear.

A BOOM in awareness and adoption

Even though the price is stagnating, crypto adoption and awareness aren’t, which is one reason why there’s growing optimism about Bitcoin. From its inception to the fact that BTC’s symbol was embedded into Unicode, the digital token has found a place in the public consciousness.

Then came the initially slow but currently quick parade of companies accepting Bitcoin for payment or investing in it, including:

- MicroStrategy

- Tesla

- KFC

- Block.

These companies had a significant role in spreading awareness of Bitcoin and persuading those eager about the digital coin to try it.

Bitcoin has also made progress on a governmental level. Recently, and much to the surprise of some foreign leaders, the Central African Republic named Bitcoin as a legal tender. El Salvador, too, legalized Bitcoin, and many more countries are looking forward to regulating and legalizing it one day.

The road to maturity

It takes a village to raise a child, as the saying goes. Bitcoin, Ethereum, and other cryptocurrencies will keep maturing, but the village must support its growth. Constant innovation is needed, visionaries in the space are needed, but most importantly, boundaries are needed.

When policymakers and regulators establish parameters, innovators can explore and experiment with emerging technologies within safe confines and in a stable, sustainable manner. Innovation without clear regulatory frameworks can only bring risks and eventually suffocate the project’s growth.

Thankfully, progress is being made. Look at Asia. Hong Kong has announced the foundation of a new regulatory system for cryptocurrencies to combat terrorist financing risks and money laundering. Japan keeps adjusting its crypto laws to meet dynamic market demands.

Despite the recent loss of trust, continued institutional investment is a reminder that centralized corporations failed first, not crypto’s core technology.

These days, the Twitter community celebrates

When Bitcoin’s birthday comes, the crypto community on Twitter is brimming with joy and expressing their opinions, sharing jokes, updating statuses, and posting memes, from the common investor to the most renowned names holding the token.

Of course, Bitcoin’s recent price isn’t much to rejoice over. But some companies still embrace it. For example, did you know that ANC, one of Ukraine’s leading pharmacy chains, announced that it will now accept Bitcoin as a payment option?

Last words

The lessons learned from Bitcoin’s short 14-year existence will shape the future of digital finance. To ensure crypto’s long-term survival, it would be crucial for measures that integrated general responsibility, regulatory discipline, and accountability to come into play.

Otherwise, Bitcoin’s promise to reshape the financial world to be more inclusive, secure, and democratic may be ignored.