Traders Short Ethereum as Grayscale Pulls Futures ETF Plan

Grayscale, a leading cryptocurrency asset manager, has unexpectedly withdrawn its application for an Ethereum futures exchange-traded fund (ETF) just weeks before the U.S. Securities and Exchange Commission (SEC) was set to make a decision on it.

This move has left many in the industry speculating about the implications for the future of Ethereum-based investment products.

TLDR

- Grayscale has withdrawn its application for an Ethereum futures ETF, surprising many in the industry.

- The withdrawal comes just weeks before the SEC’s deadline to decide on several spot Ethereum ETF applications.

- Analysts speculate that Grayscale’s move may be a strategic shift away from pursuing legal action against the SEC.

- Traders are increasingly shorting Ethereum, anticipating further price declines amid regulatory uncertainty.

- The crypto community and analysts are growing skeptical about the chances of spot Ethereum ETF approval by the SEC.

Grayscale’s decision to pull its Ethereum futures ETF application comes as a surprise to many, particularly given the timing.

The SEC was scheduled to make a final decision on the application by May 30, and some analysts had previously speculated that Grayscale was using the futures ETF as a strategic “trojan horse” to pressure the SEC into approving a spot Ethereum ETF.

James Seyffart, a Bloomberg ETF analyst, expressed confusion about Grayscale’s motivations for withdrawing the application now, especially with the SEC set to make decisions on several spot Ethereum ETF applications in the coming weeks.

UPDATE This is interesting. @Grayscale just withdrew their 19b-4 filing for an #Ethereum futures ETF. This was essentially a trojan horse filing in my view, in order to create the same circumstances that allowed Grayscale to win the $GBTC lawsuit (approve futures deny spot) pic.twitter.com/Kihj2dlQx1

— James Seyffart (@JSeyff) May 7, 2024

Regulatory Uncertainty and Market Sentiment

The withdrawal of Grayscale’s Ethereum futures ETF application comes amid growing uncertainty surrounding the regulatory status of Ethereum.

Recent comments from SEC Chair Gary Gensler suggest that the agency is still weighing its decision on spot Ethereum ETFs, with no clear indication of which way it will lean.

This regulatory uncertainty appears to be influencing market sentiment, as evidenced by the increasing number of traders taking short positions on Ethereum.

According to liquidation data, a mere 3% rebound in Ether’s price would wipe out $345 million in short positions, while a 3% drop would only liquidate $237 million in long positions.

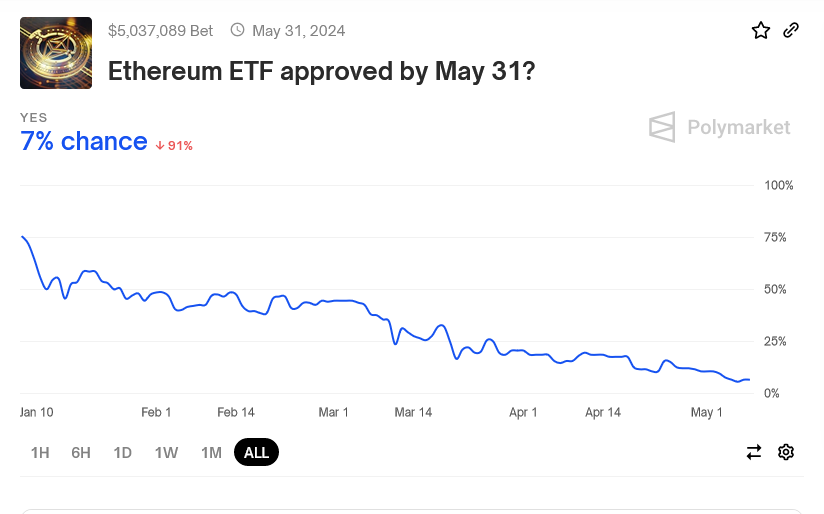

The crypto community also seems to be losing confidence in the prospects of spot Ethereum ETF approval. A poll conducted by the crypto predictions platform Polymarket revealed that 92% of participants believe the SEC will deny spot Ethereum ETFs next month.

In addition to the regulatory challenges, there are also concerns about Ethereum’s overall usage and lack of speculative interest from short-term holders (STH).

On-chain analyst James Check noted that Ethereum’s usage is currently so low that its burn mechanism is not keeping up with issuance to validators.

Usage of Ethereum is currently so low, that their burn mechanism is not keeping up with issuance to validators.

Gas prices are below 4gwei, which you have to go back to early 2020, and pre ‘defi summer’, to find an equivalent period of low demand.

‘but mah L2 scaling’ –> The… https://t.co/WUHyG9YKFF

— _Checkmate ????????

???? (@_Checkmatey_) May 8, 2024

Glassnode, a crypto analytics firm, attributes Ethereum’s underperformance relative to Bitcoin in this cycle to a “measurable lag in speculative interest” from the STH cohort.

Despite these concerns, some traders remain optimistic about Ethereum’s long-term prospects, with predictions of a potential price breakout by the end of the year.

However, the immediate future remains uncertain as the crypto community awaits the SEC’s decisions on spot Ethereum ETFs and watches for further developments in the regulatory landscape.

The post Traders Short Ethereum as Grayscale Pulls Futures ETF Plan appeared first on Blockonomi.